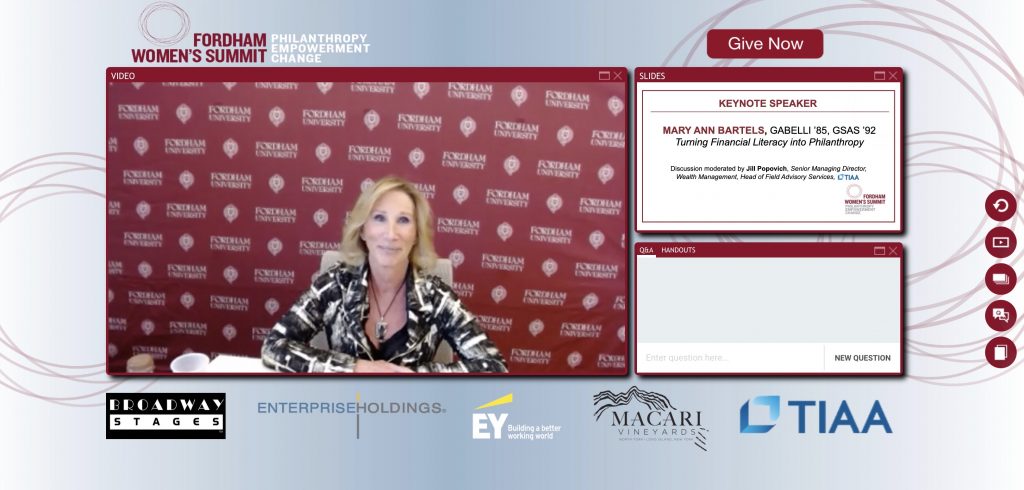

Those words from keynote speaker Mary Ann Bartels, GABELLI ’85, GSAS ’92, summed up the sentiment at the fourth annual Fordham Women’s Summit: Philanthropy | Empowerment | Change, held on Oct. 21. The annual summit is an opportunity for women across Fordham to focus on philanthropy, leadership, personal growth, and professional development. This year, the virtual event drew more than 400 Fordham alumnae, parents, faculty, and friends who tuned in from locations around the globe. From the comfort of their own homes, they listened to expert financial advice and heard from four panels that explored topics like personal resilience, maintaining a career—and a household—amid a pandemic, and relinquishing the need for perfection.

A key theme of the summit was the importance of investing at a young age and learning how to create a plan for personal finances and philanthropy. In her keynote speech “Turning Financial Literacy into Philanthropy,” Bartels broke down complex topics in finance and offered advice for women that spanned generations.

Bartels spent more than three decades on Wall Street, where she developed research that helped advisers and clients make better investment decisions. She worked for more than 20 years at Bank of America Merrill Lynch, where she was known as a thought leader, and she’s appeared frequently on CNBC, Bloomberg, and Fox Business.

She opened her speech with a few powerful statistics, including the percentage growth of women-owned businesses.

“When we look at the employment that they are creating over the last five years, that’s actually up 8% compared to [the growth of] all businesses of 2%. And when we look at women of color in the businesses that they are developing, their growth rate is at 43%,” Bartels said. “So not only will women have financial power—they’re creating new financial power.”

Riding Out the Market Cycles

Bartels explained the big ideas behind finances to help her audience make better financial decisions.

Markets have cycles that are generally controlled by fear and greed, she said. But more importantly, they tend to move in an upward trend. Long cycles tend to last 18 to 20 years, and the good news is that the most recent “uptrend” started in 2013, she said. She predicted that the U.S. will see at least one more decade of markets that reach new highs. But she also stressed that it’s critical to hold on to some investments even when the markets tank.

“I can’t tell you the countless clients that came out during the financial crisis of 2008 and 2009 and never put money back in the markets again. Markets, I can guarantee you, will always go down. Do they always go down 50%? No. Will they go down 50% again? Yes, because that is the power of markets. That’s the power of fear and greed,” Bartels said. “But the diversified portfolio? If you hold it over time, you add to it over time, you collect dividends over time, that’s where the compounding and growth comes from … It’s called patience.”

Perhaps most importantly, she urged the audience to start saving, investing, and growing their assets at an early age.

“Build a solid financial foundation for yourself before you have any significant percentage of your assets given to someone else,” Bartels stressed.

First Steps Into Philanthropy

When you’re ready to start giving, ask your parents or family members about their financial advisers and find someone trustworthy who will listen to your needs, Bartels said.

“There are many advisers that will want to sit there and lecture you on what you should do, but they don’t listen to what you need or what’s important to you,” Bartels said.

Bartels parceled out other pieces of philanthropic advice: Invest in things that are important to you, your community, and the world. Contribute, but don’t overextend. Consider seven key categories: family, finances, health, home, work, leisure, and giving. Don’t be afraid to ask charities how exactly your money will be spent. Finally, imagine your individual power as a single voice or instrument.

“It’s beautiful to listen to one voice. But when you take a choir and listen to all the voices, it just magnifies—or if you take one instrument and you start blending in more instruments and creating a symphony, how much more powerful that becomes,” Bartels said. “Become that instrument to create that symphony that can have that impact [on] what is important to you.”

Honoring Pioneering Women

At the beginning of the summit, three accomplished women in the Fordham community were honored as “Pioneering Women in Philanthropy”: Mary Heyser, R.S.H.M., MC ’62 and Monica Kevin, O.S.U., UGE ’48, GSAS ’61, ’64, who were honored posthumously, and Regina Pitaro, FCRH ’76.

The Impact of Scholarship Gifts

The event’s student scholar speaker, Taylor Bell, a sophomore studying international studies at Fordham College at Rose Hill and a member of the rowing team, spoke about how scholarship giving can help level the playing field.

“Without scholarship support, there would be very few students of color at this institution,” said Bell, a recipient of the William Loschert and Paul Guenther endowed scholarships. “There’s such a gap between the marginalized and privileged in our community, and within that gap exists an opportunity to both educate those who have not known a life with such limitations and to expose possibilities to those who have been on the outside looking in for far too long.”

[doptg id=”168″]