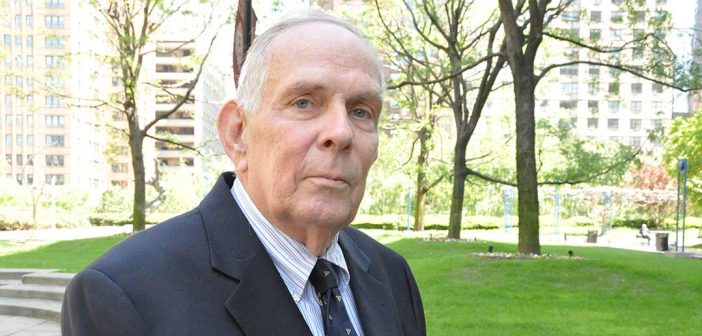

International finance expert James Lothian, PhD, the Distinguished Professor of Finance at the Gabelli School of Business and holder of the Toppeta Family Chair in Global Financial Markets, answers 4 key questions on Britain’s June 23 vote to withdraw from the European Union.

1) For the uninitiated, why is the future of the European Union such a big deal? Or is it?

As things have turned out, the E.U. is not that big of a deal. The initial impetus was good–get rid of barriers to trade in Europe. That was a big plus.

One major minus was that trade with the rest of the world remained inhibited by tariffs and other non-tariff barriers. Pick any consumer durable–say a TV, a computer or an electric drill–and you will pay at least 25 percent more in an E.U. country than in the United States.

The second was that the E.U. has become a big bureaucracy that grows like [wild] year in and year out. That bureaucracy does what bureaucrats do. They inflict costs on the rest of society in the form of taxes and regulations. All of these things have costs in terms of diminished productivity and real GDP growth. People are made worse off.

And they restrict human freedom. European bureaucrats could not give a fig about the common man and woman. Theirs is a power trip.

Washington is getting out of control in this regard. Brussels [the Belgian city the European Union calls home]is worse. It does, however, have one saving grace: more Michelin-starred restaurants than any city other than Paris. And guess who pays the expense account bills for that?

2) The European Union is obviously a huge economic entity, but with some obviously shaky partners such as Greece. [Will the] pullout by Britain, one of the largest members of the union, signal an imminent collapse of the EU?

No, but it [is] a wake up call. Some other countries may start thinking hard about costs vs. returns from membership in the E.U., and more importantly, the single currency.

3) What is the potential impact on the U.S. dollar and commerce?

A leave [will] be good for us, not huge but a positive. Trade between the U.K. and the United States, which is already considerable, [will] increase further. The E.U. has free trade within its bloc, but 20 percent tariffs on goods from the rest of the world.

4) If there are [stock]losses, will they be short-term or long-term?

The idea underlying theme is that real GDP will plummet and that those declines will feed directly into stock prices. The fact is that the U.K.’s real GDP is more likely to increase. Correspondingly, spillovers abroad will be minimal. Trade will not come to an end. It very likely will increase on net. Income will not fall. It very likely will rise. The only losers on this deal are the bureaucrats and the protected industries in the E.U. that would have to compete with industries in the rest of the world.

–Interview conducted and edited by John Schoonejongen